We can all use a little advice when it comes to financial savviness. What better place to score financial advice than from the world’s most successful people. Keep reading to find out which wealth management tips some of the world’s richest and most successful people believe are the keys to their success.

If you’re looking to reach financial freedom, you need some wealth management tips. It’s not just about making money, but how to manage it right. Making your money work for you so that it can grow is an important part of wealth management. But there are so many tips financial experts have to share that can be very helpful to the average person. Here’s a closer look at what some advice the world’s wealthiest people have to share.

Warren Buffet: Think Long-Term

Everyone knows that self-made millionaire Warren Buffet knows a thing or two about wealth management. With a current net worth of nearly $70 billion (and counting!), it’s safe to say that Buffet’s wealth management strategies are effective. One of his best financial tips is to think long-term. If you’re looking to make an investment that will double your wealth tomorrow, think again.

Buffet believes in patiently waiting. It is the one of the many financial strategies he relies for wealth building, in addition to living below your means, saving, and choosing safe investments. Buffet was once recorded as having said, “Successful investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: You can’t produce a baby in one month by getting nine women pregnant.”

On other words, there is no super quick way to go around this. When investing in something, think about how this can help you long-term and how your investment can grow long-term. Do not invest in fly-by-night operations in an effort to make money quicker. This can lead to an unexpected financial failure. Instead, think slow and steady.

Elon Musk: Diversify Your Investments

Billionaire Elon Musk touts this wealth management tip as one of the most important ones to follow. You should always diversify your investments. In other words, don’t put all of your eggs in one basket. Musk’s current net worth is roughly $300 billion. So, it’s safe to say he knows a thing or two about investing and growing your cash flow.

Musk applies this principle to investments he makes as well as his own businesses. He operates with a number of different technologies, investing in everything from cars to rockets to Paypal, the world’s most trusted online payment application. Diversifying your investments can protect you from financial loss. As one investment suffers, another may be blossoming. The idea is to have many funds that each grow at different times. And if one fails, at least all of your wealth isn’t gone in an instant.

Bernard Arnault: Be Patient

Worth over $195 million, the owner of Louis Vuitton Moet Hennessy (LVMH) has actually made his fair share of financial mistakes. One of his biggest regrets was selling off a brand that wasn’t performing well far too quickly. In retrospect, he says he learned the right thing to do with a failing business is find out why it isn’t working and improve it. The same can be applied to personal finances.

The bottom line is, you can’t make hasty decisions. Things can change and sometimes, one more day of thinking something through can prevent you from making a silly financial mistake. Take your time and never invest or sell stock in a rush. Stay up-to-date with your finances and how your investments are doing so you can prepare for things in advance.

Bill Gates: Grow Your Wealth

According to Bill Gates, who is currently worth a cool $135 billion, growing your wealth should be one of your financial focal points. Even if you are born into money, Gates believes investing that money and putting it to work is the best thing you can do to grow your money and secure your financial future. If you don’t know where to start, you can and should meet with a financial advisor. They can help you understand more about investing so you aren’t operating with your eyes closed.

You want to fully understand how investing works so you can be in control of your own money. Understanding how stocks and investments work can help you save money and invest wisely. When you invest properly, your wealth should continue to grow without any effort from you.

Mark Zuckerberg: Don’t Invest in Depreciating Assets

The founder of Facebook may be worth $115 billion but you won’t soon catch him riding around town in a Bentley. Zuckerberg is a firm believer in spending money on things that appreciate in value, like a home for instance, instead of depreciating assets like cars. A vehicle depreciates so quickly that it’s basically money wasted. You can’t build more wealth if you’re throwing it out the window.

Instead, Zuckerberg chooses to drive a low-key vehicle and save his money for investments that can generate even more revenue. This is one financial tip that not every billionaire loves by but it seems to work for him.

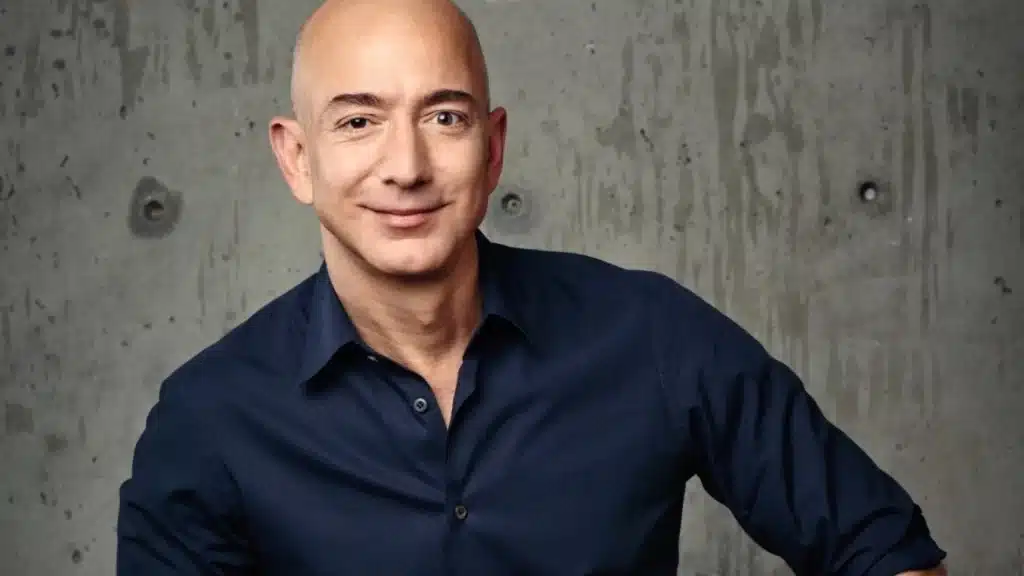

Jeff Bezos: Invest Where the Market is Going

This is a little more of a tricky tip but it seems to work well for Amazon mogul Jeff Bezos. With an estimated net worth of $187 billion, he must have learned a little something about wealth management along the way. Bezos believes in keeping your eyes and ears open so you can see where the market is heading. When it comes time to investing your money, invest in companies that are offering technologies you believe the world will be gravitating towards soon.

This can be tough so you should meet with a finance or tech expert before you make any decisions. Bezos himself seems to have a gift for predicting where things are headed. Investing in areas that will see incredible growth can help you manage your money and make more of it.

Kevin O’Leary: Skip Out on New Stocks

New stocks like cryptocurrencies and other newly traded businesses are dominating your news feed, but that doesn’t mean you should be investing in them. At least not according to Kevin O’Leary, also known as Mr. Wonderful. At a net worth of over $400 million, the Shark Tank star says you should avoid new, flashy stocks. Instead, he recommends sticking to more familiar ones with less room for bankruptcy.

His personal favourite stocks to invest in are Exxon, Home Depot, and Johnson & Johnson. The new stocks out there may seem very tempting but in the long-term, they’re a quick and easy way to lose your money. Stick with sure things instead. It may take longer to accumulate or grow your wealth this way but the long-term plan is the best plan.

Michael Bloomberg: Adapt

While it is important to have a set financial plan in place, you can never account for every possible outcome. According to Bloomberg, remaining rigid when things are going off course can be your downfall. You may have committed to investing a certain amount of money every week, but if you lose your job, you’ll have to change your plan accordingly – even if only temporarily.

Being adaptable and learning to go with the flow can be very helpful as you move forward in your financial endeavours. If you find things going off course, stop and re-evaluate. What is the best course of action given what you’re now dealing with, not what you thought you’d be dealing with? Even the most secure and safe financial plans will need to adapt over time to allow you to continue making the most of your finances.

Larry Page: Set Big Goals

One of the founders of Google with a current estimated net worth of nearly $120 billion, Page has some insight when it comes to wealth management tips. He says it’s best to set big goals for yourself as opposed to small ones. Don’t tell yourself you can’t achieve something or hit the target you want. Instead, make it happen. The logic behind this thinking is that Page himself is a risk-taker and it has served him well.

The thinking is that we never quite achieve all of our goals. If we set the bar low, we achieve even lower. If we set it higher, the minimum is still much greater on a big goal than a mediocre one.

Dave Koch: Save More

Even with a net worth of over $50 billion, Dave Koch says everyone should be a little more frugal. The best way to grow your wealth, according to the American businessman, is to reduce your spending. Koch says most people spend the largest portion of their money on groceries. In an effort to reduce overspending, Koch says not to shop hungry and to prepare a list beforehand. He also recommends hunting for sales and stocking up when prices are lowest. Koch also advises against buying brand name clothing and other non-essentials. Whatever you don’t spend there, you can easily save.

Saving money instead of wasting it can help you grow your wealth, say goodbye to debt and get a few steps closer to financial freedom.

Wealth Management Tips for Beginners

Growing your wealth can be easier than you think. Here are some more financial tips for growing your wealth and managing your finances better.

Reduce and Avoid Debt

If you are struggling with debt, do whatever you can to eliminate that debt. Before you buy anything you don’t need (non-essentials) put every penny you have towards that debt. Debt is the biggest financial drain on any household. To simplify things, create a spreadsheet to track your debt and your repayments. Once your debt is paid off, continue tracking your incoming and outgoing funds with your spreadsheet to ensure you don’t get caught up in debt again.

Understand the Difference Between Wants and Needs

Many things seem commonplace today like owning multiple cars, televisions, and other pricey electronics. That doesn’t mean you need to buy all of those items. Learn to tell the difference between what you actually need and what is simply a want. Try to cut your wants down as much as possible and put all the funds you would’ve spent on those wants in your savings instead.

Set Up Automatic Savings

If you have trouble saving money, set up an automatic transfer. Whether you save $25 a week or $1,000 a week, it still adds up at the end of the year. You should aim to save at least 10% of your income every paycheck but every cent you can out away is still better than putting nothing away. Once you have accumulated a lump sum, you can invest in a secure bond so your money can make more money.

Live Below Your Means

No matter how much money you earn, it will be difficult for you to save anything at all if you continue to live beyond your means. Instead of creating bills you can’t afford, aim to spend less than you make so the rest can be saved up.

Get Financially Savvy

Not everyone grows up in an environment where they learn about money and finances. And we know no one is teaching personal finance in school either. Learning about personal finance can help you save more and build your financial future. The best ways to do this are by meeting with financial experts and reading books about personal finance. If you aren’t sure what to do, ask your financial advisor for tips and be open to learning. It can be a long process, but it’s worth it.

Expect it to Take Time

The biggest take-away from the billionaire tips in this article is that making money and building wealth tale time. Don’t look for overnight get rich quick schemes. Instead, stick with a tried, tested, and true strategy and be patient. Growing your wealth takes time but the payoff is worth is.

Evaluate Interest Rates

Try to get the highest rates for money you invest and the lowest for things you have to pay. Always ask yourself where and how you can get the lowest rate for your payments. For example, with such low-interest rates on mortgages, does it make more sense to take a loan from the used car dealership or from your mortgage? Always look at the whole financial puzzle when evaluating, not just a piece of it. This is a wealth management tip that can help everyone earn money, from the everyday Joe to the wealthiest people in the world.

Stay Organized

Keeping on top of your finances and your investments is a very important step in managing your finances. You can’t lose track of your incoming or outgoing funds. You should stick to a spreadsheet so you don’t overspend. Losing yourself in a mess of bills can make it very difficult for you to stay on top of your finances. Track your investments, as well. Is there any opportunity to move things around and earn more interest?

Invest More than You Spend

Spending money on things like fancy dinners, cars, and designer clothes will do nothing to help you gain wealth. But investing will. You can still spend and enjoy your life, but make sure you are investing more than you are spending. Money spent on items that don’t appreciate in value is basically money that isn’t doing anything for you except giving you the momentary pleasure of acquiring something new. Investing will give you even more money down the line.

Use Cash Whenever Possible

Try to use cash whenever you can so you avoid racking up debt. In the age of online shopping, this can mean using your debit card to make payments instead of your credit card. The “buy no, pay later” mentality has left millions of Canadians struggling financially. Using cash can eliminate your tendency to overspend and you won’t have to worry about interest accumulating.

Think About Tomorrow

You may think about what you need today and tomorrow, but you must also put some focus on how you will live in your old age. In your golden years, you won’t be able to go off and earn money the same way you can today. Just because you earn $100 today, doesn’t mean you should spend it all today. Save a portion of your earnings regularly for the days where you earn $0 in the future. An important part of wealth management tips is learning to save for your retirement.

Don’t Keep Up with the Jones’s

The world of social media can make it seem like everyone is living large – but that doesn’t mean you should be. Too many people get caught up in debt trying to live a life they can’t really afford. The best wealth management tip you can get is to live based on your income, not someone else’s.