Table of Contents

ToggleWhat are the easiest ways to finance a new business?

Well, in the business market, you make your stay depending on the strategies you have chosen to get on.

If you are 9 to 5 job person, you might want some twisting in your life in terms of having your own business that can give you mind peace to stop worrying for job timings. In the early days of life, most of us mean childhood, and at the age of teenagers, we all dream of having something on our own. Those small possessions tend to be life turning points. And then we start exploring ways to have something “business” of our own.

I hope you will find the perfect way to give yourself a start in this article. Additionally, I have compiled different and easiest ways to finance your business, either small or well established.

At the end of the article, consider the take away to give your new business a kick start within minutes.

Easiest ways to Finance business

Easily financing the new business depends upon your priorities. In general, the easiest way is the one which is in your approach. Other strategies or ways that tend to be far from your hand get a bit difficult to adapt.

1. Alleviation

The reason why I have placed alleviation on top is that it is an easy approach; however, a bit painful, but after making a decision, you can have a good and secure start. Alleviation refers to the downsizing of the things you possess. For instance, you own a car that you sell to start your new business and have a small car until your business gets established.

Sacrificing your things might be painful, but the progress you made from them can help you built more. Another reason why alleviation is a good start is that you won’t have to be bound in any interest matters or lend money. The money you have is yours, and you can have a good stress free start without thinking to pay back to anyone or meet their deadlines.

Even if you don’t find yourself in condition to sell any of your things to have a start, you can look below for other ways (each way might have an enticing statement as well as a box of requirements).

2. Loans

Loans, no doubt, can help you to take a well defined big start. Borrowing money from banks, financial institutions, or progressive lenders might help you in financing your business. But the important thing you need to keep in mind is their policies. Some banks give loans on following their strict requirements, and others might give some space. However, there are several loan options which you can adapt to kick start your business.

- Microloans

The Canadian government and unions have started programs such as Microfinance programs to help businesses grow. These programs help people by giving microloans to establish their businesses with a small amount of money, even at $5000. According to Intuit Canada, 77% have started their business with less than $5000.

However, if you have bad credit history or score, you won’t get a maximum loan amount; rather, you will be restricted to the small loan packages. For this purpose, these programs approve loans under $20,000 to people with poor credit history.

- BDC Xpansion Loan

Applying for a BDC Xpansion loan might get a little hard as the loan will only be available to you if your business gets approved. After approval, the loan you received is up to $100,000, which you can use to do business-related tasks such as making marketing plans, developing e-commerce, trade shows, and vice versa. Additionally, the BDC (Business Developed Bank of Canada) also offers re-advance with a minimum of $10,000.

- Community Loan Funds

An organization, “Community Investment funds,” helps people have loans from a minimum range of $2000 to $150,000. If you wish to have a loan from lending financial institutions and could not make it, you can approach community-based loan funding organizations. The organizations will provide you loans depending on specific requirements from the range mentioned above.

3. Retirement Savings

You might save some amount of money in your retirement savings as plans. This can be great if you think twice (as each way has some benefits and drawbacks). You can utilize your retirement savings to start a new business that is safe and free of risks.

In case of using your retirement savings before your retirement can get you into a problem if your business doesn’t bring stability. You might face no income and zero retirement savings, left with some pennies.

However, don’t get yourself back, as a wise step will lead you to a better opportunity. Keep yourself straight!

4. Life insurance

If you have life insurance, then this easiest way to finance your business is for you. You might not have known to the fact that you can have a loan against your life insurance without worrying about paying back. As if you do not repay the amount, they will only reduce the money given to your beneficiary in the future.

Moreover, several insurance companies in Canada allow you to borrow against your life insurance policy. Therefore, you can use your life insurance as collateral or take the policy loan out of it.

Also read Understanding how Insurance commissions work.

5. Venture capital

Venture capital or angel investors must consider ways if you want a pre-planned and fully adaptable business that can give you have to make money. Venture capital is a group of investors or executives who buy an equity stake and provide you with cash to get started. As I mentioned earlier, they can be the right choice as they provide consistent guidance with expertise, market experience, contacts, and investment before starting. However, if you fail to make progress, they might use an exit strategy to take their profits and quit investing in your business. The period they follow is up to three to five years.

6. Credit cards

Credit cards are always an alluring element when it comes to financing—the rewards in terms of points and cashback. There is no doubt that credit cards provide high capital from $10,000 to $50,000 for small businesses. So, you have investment for your business without getting into loan approval applications.

Moreover, you might have heard the success stories of people they made from credit cards. However, what they might don’t tell you or maybe some of them have the drawbacks of using a credit card for building credit. Therefore, always look for what risks you might have to face is considering.

A credit card is a good deal if you make on-time payments. Otherwise, you have to pay interest that credit card issuer, and this might be the main factor responsible for not succeeding in establishing a business.

7. Crowdfunding

In general terms, crowdfunding is the same as asking other people to help you run your business by investing their money. You can approach different crowdfunding platforms to get a kick start your business. The crowdfunding platforms allow you to show your business proposal to the linked people.

You have to create a decent business proposal with all the details, such as the amount of money you need for establishing and your business’s purpose. If any of the investors find your request valuable, he/she will accept and provide you a loan to start your business.

Another benefit of approaching crowdfunding platforms is that some reward-based, meaning you don’t have to pay the money back to the investor; instead, you offer them rewards. For instance, if you manufacture things with high market values, you can give the first sample of your work to the investor as a reward.

While other crowdfunding platforms are based on traditional loan lending, you have to pay back the exact amount of money to the lender; however, before going for crowdfunding, make sure you read and understand how it works.

8. Pre-sales

Pre-sales is another way to establish your business even before you think to start. Presales refers to the selling of your product in the market before setting a profitable business.

There are several ways to sell your product; either you start from online platforms to advertise on base levels or participate in the related convention. The advertisements allow small leveled selling of your products to help you make your business prosper even before landing in the market. On the other hand, participating in conventions can make your chance. If the retailers get inspire by your idea, he would ask you to develop more. Plus, he would invest in your business to make a better start.

9. Side work

There is always a room for more, for starting a new business and searching for investment, the best way is to earn passive income. The money you make from passive income earning platforms such as Freelancer, Upwork, Uber, and other sites can help you finance your business. Start earning and run your business side by side.

10. Federal Grants

The government of Canada offers different grants to entrepreneurs living in Canada. Before going to start your new business, the best way for investment is to approach government grants. These grants are non-payable, and you can start your business without stressing to pay the money back. The grants are good to take a new business start. However, these grants are only for science and technology-related businesses, and some grants might be available in Ontario only. The grants include;

- Industrial Research Assistance Program (IRAP)

- Scientific Research and Experimental Development (SR&ED)

- Smarts tart

Financing small business

If you are about to start a business that does not require high paying loans or investment, then you are more to the safe side. There are several ways you can adapt to make your business progress more. However, only one or two business financing ways are truly a good option, while others have two sides. The progress of business depends on how you adapt the strategy and calculate the risks it may have. If you deal and handle the consequences, you can make your way to a better business set up.

Ways to finance small business

Before starting to finance your small business, keep two main ways to get the game to begin.

Equity

Equity refers to selling your business equity stake to the other person. In other words, you make a partnership with that person you are selling the business equity state. Further, you do not have to pay back to the person; instead, he shares all the benefits and cash values earning from the business.

Debt

Debt is a procedure of lending money from financial institutions or lenders with a guarantee of paying the money back within the given time frame. The loans can be secured or unsecured. Secured loans allow lenders to take your assets in case of not paying the money back. Whereas, unsecured loans do not require any asset for their security.

To start a small business, you can adopt any of the ways according to your circumstances.

1. Savings

Like, alleviation savings is as easy to do. Savings is a secure way of starting a new business as you do not need to lend money, pay increase Interest rates, or facing any loss if not returned on time. In savings, you have to save an amount for establishing your business for a while. Afterward, you can have money to kick start your business. However, the amount you collect from savings would not be enough for starting a new business, but it’s a safe start.

2. Friends and family

Another way to start to new business is by taking help from your friend and family. This can also be a safe way to kick start your business.

You need to ask your friends or family member if they are willing to help you run your business by investing money.

Before going to take help from friends and family, keep two things in mind. Either you feel yourself to cope with any downfall or partners’ involvement in your business. If, so then it’s a good option for you. Otherwise, don’t dig yourself into something you can’t handle because apart business dealings, relationships should matter.

3. Others

From the above discussion, you might have an idea which ways will suit you better. While for your small business setup, you can get microloans as well.

Also, read Tips on Starting Your Small Business.

Take Away

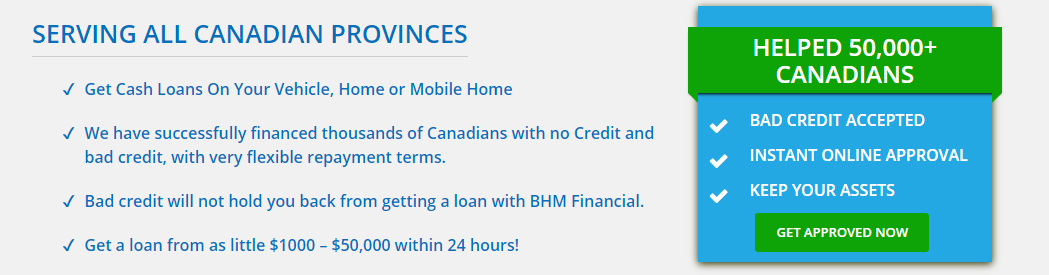

If you want to get started right now, click and follow instructions to get a loan within 24 Hours. From this site, you get a loan based on your assets rather than your credit.

Final words

Summarize the whole discussion on the easiest way to finance your new business and provide you with a take away with approaches to different sites that help you get loans or stairs to establish your new business. I hope you will take a step soon and start sharing your business success stories in no time.

Best of luck!

FAQ

1. Is it hard to get a loan to start my new business?

Depending on the strategy you choose defines the hardness in getting a loan for your business, such as going to a bank for taking a loan, you might have to go through a detailed procedure and vice versa. However, several sites help you get a loan within a minimum, such as BHM Financial.

2. How can I finance my new business?

Try to start your new business with your savings or funds and then search for a partner if you feel to have someone’s help set your new business. Otherwise, look for better loan options and give your business a start.

3. If I want to apply for a bank loan, what do they look for?

The banks look for basic 5-C’s related to your credit, such as your total capital, character, condition, collateral, and capacity. If you do not meet any of these requirements in your business, you might have to face disapproval for a business loan.

4. What is the average amount of loan I can get for my business?

Range of business loans that you can get from lenders is $100,000 to $5 million. However, some lenders or financial institutions give even lower loan for new business setups.

5. How can I get funds?

The several sources to get funds are angle investors, donations, savings, grants, and crowdfunding.

6. What are the different types of finance?

Three main types of finance are corporate, public, government, and personal investments.

References

https://money.howstuffworks.com/10-ways-to-finance-new-business.htm#pt6

https://financialpost.com/entrepreneur/money/five-common-options-for-financing-your-small-business

https://www.nav.com/blog/best-banks-for-small-business-loans-201917/

https://due.com/blog/12-ways-finance-new-business/