How would it be like to live in the current economy without a credit card? Think about all the convenience you would miss. Maybe each one of us would have to go to the bank to withdraw or borrow some money even for minor purchases. However, the comfort that credit cardholders enjoy brings with it some downside—the credit card debt. According to GreedyRates, the average Canadian with a credit card account owes as much as $8, 600 on average. You will agree that a credit card encourages spending, and this could result in considerably high debts. Now that you are in debt, why not find out how to reduce your credit card debt and get your name in good books?

Why you may want to cut down your credit card debts

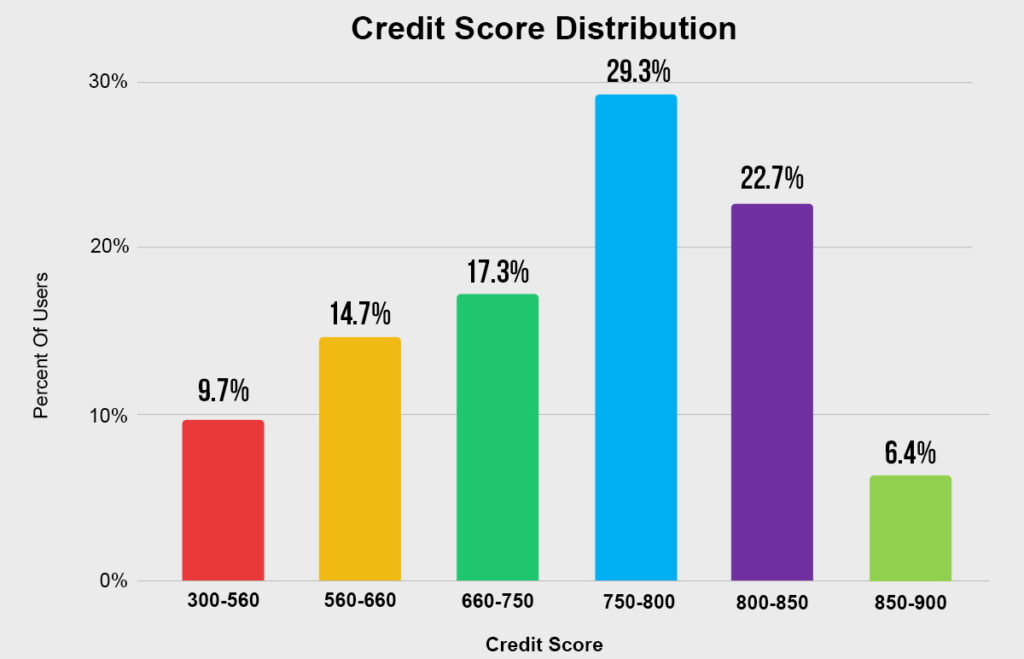

- It impacts your credit score negatively. Credit bureaus usually consider your credit card information alongside other data to create your financial profile. In general, you will get a negative credit score if you tend to take more than 30 percent of your credit limit. In turn, a negative rating may step in the way when you need to take a mortgage for a home or another essential endeavor.

- Credit card debt is expensive. The debt brings along interest rates that do not compare well with traditional mortgage interests. In the end, you pay heavily for items that could have waited for your next budget.

- It is enticing. The moment you start spending without paying up, you will always get interested in things that, without a credit card, you would have to reconsider if they were necessities or luxuries. The habit may eventually get you into the deep sea of credit card debt.

How to reduce your credit card debt

Since we cannot do away with credit cards, what are the most intuitive ways to reduce the debts?

Check your statement regularly

Many people get into bad credit card debt by assuming that the credit card statement is just another regular letter in the mailbox. Failure to track your credit card debt and institute spending limits can see you spend more in credit than you can repay in a few years. On the other hand, regularly checking your credit statement gives you a real-time balance. Again, checking your credit card statement can help you avoid unnecessary spending if you already have too much debt. And what’s with that? You do not add new debts to the credit card.

Credit card statements can help keep your spending habits in check. However, this requires principle and determination. For the best results, you should always compare your expenditure from the previous three months and identify the things you should stop doing. Is there a recurrent expenditure taking your money with little benefit? You can consider terminating such, so your debt does not get higher.

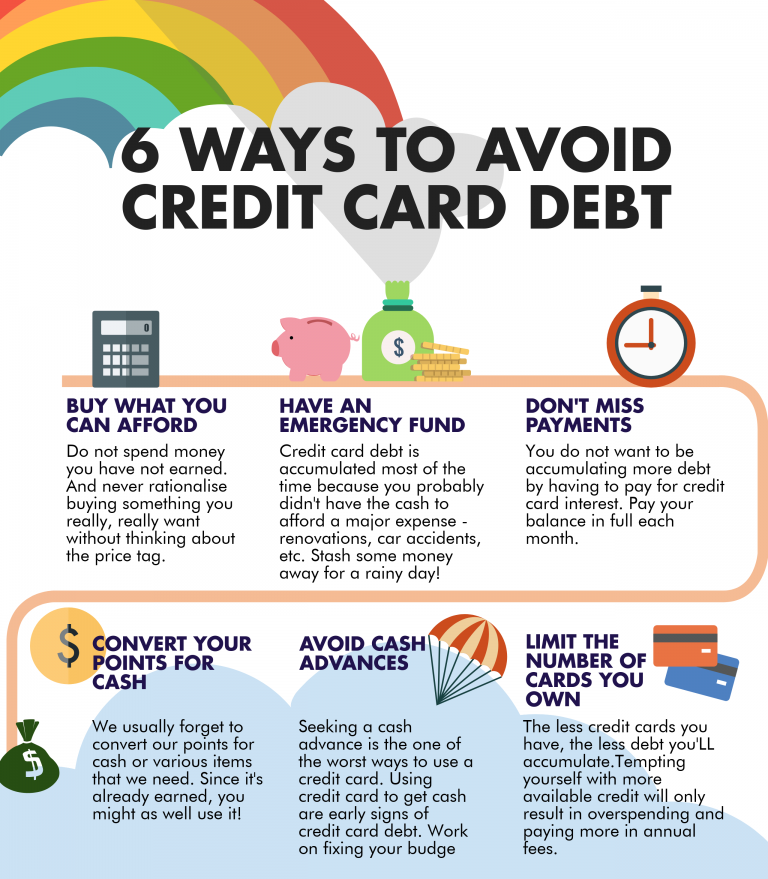

Avoid owning multiple credit cards

Did you know that people with multiple credit cards tend to spend more on a single purchase than people with only one card? And did you know that they are more prone to impulse buying? Well, these are facts, and you will probably agree if you already have multiple credit cards in your wallet. Owning several credit cards comes with the benefit of a higher cumulative spending limit. Take, for instance, if you had only one card whose credit limit stands at $10,000 and compare yourself with a person with three credit cards each with a similar limit.

Even though limited, the person with a single credit card will most likely reconsider every purchase before hitting that “pay” button. In most general cases, people with a single credit card are financially better than those with multiple. And should you terminate your credit cards? You need a strategy for the termination process, and this should include paying your credit card debts in a particular order. Say, for instance, start with high-interest rate cards first.

Check your credit limit before making another purchase

Some people rarely check credit card balances as long as a card can pay. The habit is dangerous and can put you in the books of debts even when you don’t need to. It is advisable to always know a card’s balance/limit before taking it out with you or paying for online shopping. While this will not pay your debt, it helps you know where you stand before you make payment. Checking your limits, combined with other credit card debt reduction strategies, can help you avoid new debts and spare more money to pay the debt owed on other cards.

Increase your monthly payment

Are you still paying the bare minimum? It is almost impossible–or say, it will take you longer and accrue more interest–to clear your credit card debts by paying only the minimum required amount. The case is even worse when you have multiple cards with different APRs.

What should you do? The quickest way to get rid of credit card debt is through paying monthly installments higher than the minimum. In a scenario where you have different cards, you can prioritize the cards depending on the amount you owe on each or depending on the APRs. Either way, you should use every extra dollar to pay the prioritized card while maintaining a minimum monthly payment on the rest of the cards. This strategy should see you pay less interest on your debts and clear them off faster. Increasing monthly payments is one of the most used tricks to paying off credit card debts and works well for most people.

Have a budget

A budget is a step towards controlling your monthly expenditure. With a written budget, you will have the chance to review your expenses and save more for your debts. Again, a budget can help you avoid impulse buying. When creating a budget to cut down your credit card debt, you must sacrifice luxury and live on necessities for as long as possible. However, this does not imply denying yourself a comfortable life. Again, it may not be easy to adapt to a new lifestyle, and budget cuts should be taken incrementally over several months rather than abruptly.

The best workaround for a budget cut is perhaps by downgrading services towards basic plans whenever possible. For instance, switching to an essential TV subscription and minimizing your night-out dinners could significantly reduce your debts. It is also possible to terminate some services that you rarely use or those that affect payable bills rather than incoming revenue. Whichever way you choose, remember to include a plan for emergency expenses.

Consolidate your debts

Credit card debt consolidation is perhaps the best way to keep track and reduce how much you owe in a short period. In principle, you combine the total amount owed and put it under one card to make single monthly payments. The implication is that your monthly deposits will get higher, but it is nothing to worry about since the interest rates can get considerably low.

Three methods to consolidate your credit card debt

- Balance transfer. It involves moving your credit card debts to a single balance transfer credit card. With this type of transaction and depending on your credit score, you may enjoy up to 24 months of 0% APR. However, there may be fees of up to 5% for every balance transferred and which can be way lower than the interest you would have to pay for the debt. This option is particularly useful if you can clear all the principal debt without additional interest during the 0% APR duration.

- Take a debt consolidation loan. You can take either an unsecured or secured loan to pay off your credit card debt and other personal debts to reduce interest rates. However, secured loans can help you get a lower interest that would otherwise be unavailable depending on your credit score.

- Debt management program. This type of program should be your last option if you cannot negotiate on better terms for your loan with your creditors, or you do not want to use your assets as security for a loan. With this system, you enroll for professional debt consolidation services through a credit counseling agency. The agency then takes over your debts and institutes necessary measures to reduce/eliminate interests and penalties. You must then channel your monthly debt payments through the credit counseling firm, who will plan how much each of your creditors gets out of it. Notice that your credit cards are often frozen to prevent the accrual of new debts.

Consider credit counseling

Credit counseling is where you seek professional help on how to reduce your credit card debt. These agencies negotiate with your creditors for better payment terms, including the extension of the payment period. However, settling your debts through a credit counseling bureau has both benefits and problems. First, you may get lower interest rates, but you will have your credit cards frozen so you cannot use them. Secondly, the debt repayment period may become too long such that you can lose morale along the way and abandon the process. And third, there are several risks of working with credit counselors, including failed debt settlement and expensive charges for the services.

Note that it is possible to reduce credit card debt by using credit counseling agencies, but you should always assess the risks before signing the contract.

Avoid luxurious expenditure

There are various luxury goods, services, and activities that we pay for once or several times per month/year. However, it is advisable to skip the luxury and only pay for the necessary. Even with low savings, you will realize that the amount of debt that can be cleared by avoiding extravagance is significant. For instance, you can skip your vacation and use the funds to pay some of your credit card debt. Another example is getting a basic air ticket and saving the extra money you would have spent on a first-class or charter plane.

Pay in cash whenever possible

Many people tend to pay using credit cards even when cash would be the most appropriate. This habit ends up depleting your credit card balance, and you either knowingly or unknowingly start spending on your credit limit while cash remains in your purse unused. Also, research has that you may be tempted to give higher tips at restaurants while paying with a credit card than you would do with cash.

People tend to be more cautious when using cash than when using other forms of payment, including credit cards. And how do you avoid paying with a credit card? Perhaps the best way is to keep your card out of your wallet/purse so you don’t go with it everywhere. In the long run, this can help you save amounts that would otherwise be misspent.

Create payment goals

It is a mistake to think that you can pay off your credit card debt without a plan or payment goal. Without goals, you will easily get carried away into spending the extra dollars in your budget on purchases instead of directing them towards debt payment. And what sort of goals should you consider?

Time-based goals are widely used by people and are effective most of the time. Consider setting your monthly minimum limit that is higher than that imposed by your card issuer, and don’t forget to surprise yourself by paying more than the threshold. How about splitting your monthly limit into two or four portions? It is an excellent idea as it reduces the amount you have to pay every time and may act as a motivating factor or a weekly goal.

How can I reduce my credit card debt quickly?

Consider taking a debt consolidation loan or getting a new balance transfer card. Even if you do not wipe out the loan immediately, these methods are poised to work in less time than other strategies. You can also increase your monthly payments and decide which card to clear first.

Popular credit card payment styles include:

- Avalanche: Pay off your credit card debt, starting with the one with the highest APR, and continue until you have cleared everything. While on one card, keep paying the monthly minimums for the rest of the cards. The motivation here is that you reduce the interest you have to pay.

- Snowball: The snowball method works like the avalanche but in the opposite direction. With this method, you start paying the smallest debts first and progress until you cover everything. The disadvantage is that you do not consider the APR on each card. However, there is motivation in clearing debts.

How can I cut down on my credit card spending?

There are various ways to reduce credit card spending, regardless of the amount of debt you have. A spending limit is one control measure you can implement. With a spending limit, you must keep the card away when the limit is reached.

Another effective way is to maintain a single card or, at most, have two cards. With this method, you choose one or two cards with low APRs and an average credit limit.

One last method requires that you create a habit of paying in cash and keep the card back in the house, so you don’t get tempted to use it.

What are the best credit card debt reduction strategies?

We have discussed some of the best and most effective credit card debt reduction strategies: debt consolidation, budgeting for your purchases, creating a payment plan, and avoiding new debts as much as possible. Some of these methods do not work in isolation, and a combination of several can propel you further than a single process. Find what works for you and strictly follow the plan.

Conclusion

There is not a bulletproof way to pay off or reduce your credit card debt. However, with an objective mind, dedication, and a combination of the best credit card debt reduction strategies we have discussed, you will surely get better every month. A bad credit card debt can negatively affect your credit score and reduce your chances of getting other finance forms.

Perhaps consolidating your credit card debts using a secured loan is the fastest way to improve your credit rating and monitor your dues from a single point. If this is difficult for you, then paying higher monthly installments would work the magic. However, you can also consider credit counseling when all other methods do not seem to work or if you have a considerable debt in default or is at risk.