7 Ways Poor Credit Can Affect You Financially

Poor credit history is an often-overlooked financial problem that can affect consumers in more ways than one. Avoiding poor credit is obviously the main goal. However, life’s unforeseen events can land nearly anyone into unexpected debt. A job loss, health crisis, a global pandemic – these are all unexpected life events that can derail your financial success.

What is Good Credit vs Bad Credit?

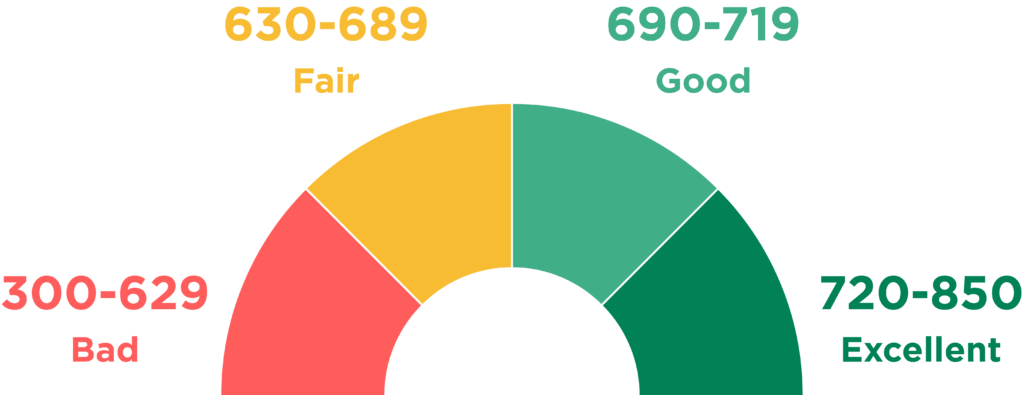

Good credit refers to a credit score that is above 670 points. Anything below falls into the fair or low credit score categories. Good credit tells lenders that you are stable, likely to complete payments, and generally, not a high-risk candidate for them. This also tells prospective employers that you are responsible and reliable.

Poor credit tells lenders you do not have enough money to pay off your lifestyle. It means you are a high-risk candidate with a high likelihood of default. This category can put many limitations on you as a consumer. There are actually many drawbacks to having poor credit.

How Do You Know if You Have Bad Credit?

If you haven’t been paying your bills on time consistently, or you have maxed out your credit cards, it’s safe to assume you have poor credit. To be sure, you can do a free credit check through websites like Borrowell and other similar sites. This will give you free access to your own credit report. Plus, checking your credit score won’t damage it any further.

What Does it Mean to Have Bad Credit?

Bad credit means your credit score falls into the low category. Anything beneath 580 points is considered very bad credit. Between 580 and 669 is considered to be fair credit. However, it should be understood that even fair isn’t quite good to have. This can still qualify as pretty poor credit for most consumers in Canada.

A low credit score means you are losing control of your finances and lenders now see you as a liability. This means anytime you need to borrow money, you will find yourself either being rejected or asked to pay exorbitant interest rates. Having bad credit can happen, but it should be fixed as quickly as possible. You try to avoid having bad credit for a prolonged period. If you find yourself with poor credit, it’s time to make debt repayment your primary goal so you can get back on track financially.

What Are the Danger Signs of Bad Credit Management?

There are several signs that will let you know your credit score is in danger. If one or more of these applies to you, you should consider meeting with a professional to discuss your credit management options:

- You have been contacted by a collections agency

- Frequently miss payment deadlines

- You have been rejected for a loan or credit card

- You have been rejected for a job based on your credit

- Rejected for insurance for your home or car based on your credit

- Your credit card company has terminated your rights to use your credit card

What Are the Consequences of Bad Credit?

Bad credit can have many negative consequences that many Canadian consumers are not even aware of. Here is a more in-depth look into the consequences of poor credit and how they can affect your financial success:

1. You Will Be Charged Higher Interest Rates

If you have poor credit and happen to need a new car, you may find yourself unable to take advantage of the low interest rates advertised. This is because the lowest rates are reserve for client’s with excellent credit. The car dealer knows the person with good credit will come through on their payments and is more inclined to offer them a lower rate. Poor credit history is consider a red flag. There is a risk to the dealer that the buyer may not follow through on their payments. To protect themselves, they charge a higher interest rate.

If you are already in debt, accruing higher interest rates will make coming out from under it nearly impossible. Some expenses are necessary, even if you are under financial strain. You may need a car to get to and from work. Paying more for that car is not ideal. The best thing to do is avoid poor credit by making payments on time and keeping your credit card usage below 80%.

However, if you are already in the cycle of debt, that option is no longer there. From this point on, your best bet is to work on increasing your credit score. You may need a debt consolidator to help you control your debt and minimize the risk of lowering your score due to late or partial payments.

2. Poor Credit Can Prevent You from Getting a Job

Some jobs, for example a loan’s officer, require a credit check. Poor credit can prevent you from getting a higher paying job and earning more money to reduce your debts. If a job depends on good credit, you may find it impossible to get out of your low paying job and into something that can help you pay off your loans faster. The problem with bad credit is that it quickly evolves into a cycle that becomes very difficult to break free of.

You may not think many jobs require a credit check, but there are actually loads of job opportunities that require a good credit score. Bank jobs, insurance company jobs, public service jobs – most of these jobs require the applicant to have at least a good credit rating. A fair or low credit rating is often insufficient for many positions in these fields.

If you want to achieve financial freedom at some point in your life, maintaining a good credit score is crucial. When debt becomes unmanageably high, it can be a challenge to avoid a poor credit score. Consolidating your debts may be the only way to free yourself of the debt and interest rates weighing you down.

3. Your Insurance Will Cost You More

Insurance is an essential part of your financial success. You may want to invest in a life insurance policy, or need homeowner’s insurance. Any insurance can come along with significantly higher payment rates if you have poor credit history. Sometimes, the rates can be so high that the insurance becomes almost unnecessary. If you have found yourself in this boat, it’s surely time to seek the advice of a professional debt handler or financial consultant.

Homeowner’s insurance and rental insurance are not mandated by law in all parts of Canada. Very often, Canadians find themselves foregoing crucial insurance because of the high fees associated with their poor credit history. Unfortunately, this can lead to catastrophic financial consequences should an emergency arise. Both paying too high a rate and foregoing insurance altogether are not good situations to be in.

The best way to navigate this situation is assess your financial plan and see how you can get your credit score to improve. This often includes debt consolidation to help you pay down your debts and interest fees as quickly as possible. This is a long-term goal. In the meantime, pay your bills on time to minimize the effects your financial situation will have on your credit.

4. You May Be Rejected for a Loan

Poor credit can also make it impossible for you to get a loan at all. Large loans, like a mortgage for example, can be increasingly difficult to get if you have poor credit. The reason being that poor credit indicates a risky customer with a high risk of not being able to follow through with their scheduled payments. While it’s always good to minimize unsecured debts, secured debts are a normal part of life. A mortgage it something most people need when buying their first homes. If your credit is preventing you from getting a mortgage, you may find yourself unable to buy your dream home.

You may also need a loan if there is serious damage to your existing home that is not covered by insurance. In this case, you may need to borrow a substantial amount from the bank. If you have a poor credit score, you may not be able to secure that much-needed loan. This can lead many Canadians to end up selling up their homes below market value and losing even more money.

5. Getting a Cell Phone

If you have poor credit and are looking to get a new cell phone, you may be surprise to learn it won’t be that simple. Telecommunications companies in North America conduct credit checks prior to securing a contract with new customers. Poor credit can prevent you from taking advantage of good pricing plans, but it some cases, you may flat out be rejected.

Poor credit tells the phone company you may not be able to pay your bills on time – or at all. This makes you a risk. You’ll quickly learn that your business isn’t quite so sought after by many private industries once your poor credit history is found out. Avoiding poor credit, or doing whatever you can to fix it, is crucial to your financial success. It’s also crucial to you securing the types of essentials most people are accustom to nowadays, like a home, a car and a cellular phone.

If you need a laptop or tablet for work but don’t have the funds to buy it today, you won’t be able to take advantage of layaway plans with poor credit. Throughout life, there are always major expenses that pop up from time to time. If you don’t have the funds to pay for them, you’ll have to rely on credit. If your credit history isn’t great, you won’t be able to make these kinds of essential purchases.

6. Getting Basic Utilities

Basic utilities, like electricity, water, and gas require consumers to set up an account. Of course, this will include a credit check. If the gas company deems your credit is too low, they may refuse to offer you the utility service that you desperately need. Or they may offer it to you at a much, much higher rate. Paying higher rates for everything only makes it tougher for you to get out of the cycle of debt.

Because these services are most certainly essential, you will have to accept the exorbitant fees that come along with it until your credit score improves. But as you can imagine, it will be tough to improve it with excessive fees and skyrocketing interest rates weighing your down. Financial freedom may see farther and farther away.

To get a hold of your financial future and start improving your credit score, you may want to consider meeting with a debt consolidating professional. They can help you reduce your debt, reduce your unnecessary fees, and build a financial plan that will get you back on track to improving your credit score.

7. Getting a new Credit Card

If you have found a new credit card that offers a lower interest rate than the one you currently have, you may want to make the switch. However, each credit application is subject to a credit check. Low credit scores will again land you in the rejection pile. You may need a credit card to pay for certain bills or take advantage of online deals. But it’s unlikely you’ll secure that low-interest card with your poor credit history. This means you’ll have to stick to the higher interest you’re paying, whether you like it or not.

Again, debt is a cycle. One part of debt problems affects another and slowly, slowly, it takes over your ability to control your financial success. The only way you can get out of the cycle is to pay your debts off and improve your credit rating.

Can Bad Credit be Fixed?

A lot of people worry bad credit can’t be resolved or that the damage is permanent. The only thing worse than poor credit is consistently poor credit. Your credit score can improve quickly if you take the appropriate steps to fixing it. Here are some tips for improving your credit score:

- Pay bills on time and in full

- Keep credit card usage below 80% of credit limit

- Avoid renegotiating your secured debts to pay off unsecured debts

- Consider consolidating your debts to reduce interest fees and pay debts off quicker

- Avoid applying for too many credit cards

- Avoid asking for credit limit increases

- You Should Avoid new hard inquiries (credit checks)

- Meet with a financial expert to help improve your score quicker

Is it True that After 7 Years Your Credit is Cleared?

Yes, after seven years have passed, your missed payments and other credit score-impacting behavior will no longer be included in your credit score calculation. Your credit score is based solely on the last seven years. For example, declaring bankruptcy will bring your credit down to zero. At that point, securing a credit card or loan will be impossible. However, after seven years, the bankruptcy will be remove from your rating.

Meeting with a Debt Consolidator

Debt consolidation is the first step to gaining control of your debt and achieving financial success. Our financial experts can help lower your interest rates and consolidate your payments. Plus, they can also help you create a budget plan and loan repayment plan that works for your needs, specifically. The key to overcoming debt is to have a secure plan that is achievable with your lifestyle.

If you are suffering from poor credit, don’t let it weigh you down any longer. Find out how you can lower your debts and improve your credit rating as soon as possible. We can help you get one step closer to excellent credit and financial freedom.

Why Choose BHM Financial?

Choosing a debt consolidator is a big decision. The goal is to solve your debt problems and get on your way to financial success. At BHM Financial, we understand that debt can happen to nearly anyone. Unexpected problems can drastically affect your finances, your debts, and your credit score. Our goal is not only to help you wipe away your debt, but remain debt-free long-term.

When you choose BHM Financial, you’re choosing to meet with a highly experienced professional who can empathize with your current situation. Together, you can work out a repayment plan that makes sense for your life and your needs. Our experts can also help you build a detailed financial plan to help you stay on track and ensure you meet your payment requirements, so you can improve your credit faster.

Contrary to what you may find online, improving your credit rating can’t happen overnight. But with a series of smart financial decisions and a plan for paying down debts as quickly as possible, we can help you improve your credit score at a steady rate. Are you ready to kiss your debts goodbye and start improving your poor credit today? Call us and see how we can help.