If you are an average income earner, you’ll agree that reconciling your financial priorities is not always an easy feat to achieve. More often than not, a ton of things are usually waiting to be paid for, even before you have access to your income. Add the global inflation and economic crises ravaging different countries to this dilemma, and you’ll see why most individuals and households are merely hanging on the breadline.

Unfortunately, the increased cost of living does not eliminate emergencies, as they always show up when you least expect them. Your car and large appliances won’t desist from breaking down because the times are hard, and neither will health challenges postpone their symptoms because you just paid a ton of bills. As a matter of fact, the harder the economy, the more likely companies will lay off some hands.

So, how do you ensure that you are financially prepared to confront these unexpected issues when they arise? The answer would be to build an emergency fund. In this article, you’ll get premium emergency fund tips and how to start and maintain one.

What Does “Emergency Fund” Mean?

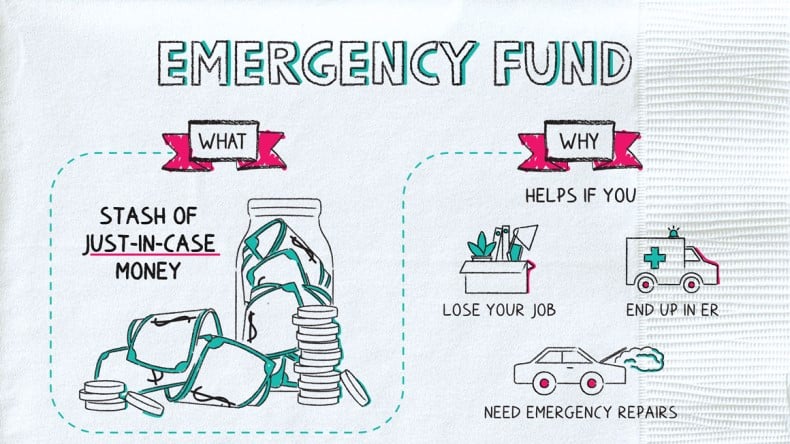

An emergency fund is an amount of money you keep aside to help cushion the effects of unexpected financial setbacks. These setbacks include unplanned medical bills, vehicle and electronic appliance repairs, or major house repairs.

An emergency fund is also a temporary financial strategy that keeps you going when your income stream gets cut off in the case of a job loss, business bankruptcy, or career setback. So, a typical emergency fund should also be able to cover your living costs for a short period.

How Much Money Do You Need In An Emergency Fund?

Unquestionably, you must have come across several pieces of financial advice suggesting that your emergency fund savings should contain a specific amount of money. Such advice may be tenable and even guarantee some form of financial security, but stating specifics regarding money may not be feasible for everybody. There are several things you should consider when determining how much money you need in an emergency fund. These factors are also the reasons one-size-fits-all isn’t the most effective when it comes to emergency funds.

- Your income, as people do not earn equally – even professionals in the same industry across Canada earn differently.

- Your peculiar expenditure and general living costs because you’ll hardly find two persons or households who share an exact amount of monthly or daily spending. Expenses like car repair, medical, grocery, housing, and even utility bills differ from person to person and location.

- Your financial risk factor, such as the stability and predictability of your income source.

- The number of dependents and financial support you receive (wealthy relatives or a working spouse).

- The nature of what you may consider as emergency or unexpected expenses. If your monthly budget covers car repairs and hospital visits, you will no longer factor those into your emergency funds.

- Your tendency (or those of your dependents) to develop any health condition.

Invariably, the amount in your emergency fund should be peculiar to you.

So, how much should that be?

Ideally, your emergency funds should cover six times your monthly expenses. But, if having up to six times your monthly expenses is impossible, try three months or less.

How To Save Money For Your Emergency Fund

It is important to note that having an emergency fund is one of the significant routes you can take to financial freedom. So, saving money for your emergency fund should be a deliberate process that should not be left to chance or convenience. The following step will help you set up and maintain an emergency fund.

Work with a financial plan

To have some funds stashed away for emergencies, you must first know and practice how to save money from your income. But saving consistently will only remain a wish if you’re yet to have some level of control over your finances. You guessed right: an emergency fund starts with budgeting and sticking to a financial plan. By so doing, you decide where your income goes, so it is not immediately engulfed by expenses (unnecessary ones included) as soon as it arrives.

Automate your emergency fund savings

As soon as you figure out what you can take from your monthly or weekly income, the next step is to ensure you do not procrastinate or fail to move that amount to your emergency savings.

There are currently hundreds of financial applications available to help you automate your emergency funds savings. These systems will automatically transfer the stipulated amount from your chequing account to your emergency funds as soon as you receive any income. If you are not very tech savvy – which you do not necessarily need to be to use most financial apps – you can have someone remind and monitor you to save your calculated emergency fund every month.

Continue saving after an emergency

Surely, you want to quickly save a specified amount of money and get the whole emergency fund savings thing off your mind. But it is safer to continue to put money into your emergency fund as long as you have the means – there’s never an excess. Continuing your emergency savings also improves your overall financial security even when you do not have any emergencies in a long time. However, emergencies happen much more often than you’d likely expect. Hence, there are tendencies that you’d dip into your emergency funds more frequently than you plan. In this case, constantly replenish any amount you take out of your emergency funds as soon as you receive your next income.

Where To Keep Your Emergency Fund

For most people, the problem isn’t building an emergency fund but how to ensure the funds are not used before “emergencies” happen. And their primary concern becomes where to put emergency fund money.

Unfortunately, some people invest their emergency funds in long-term (high-yield) investments like stocks, bonds, and real estate, so they do not have money lying around and taking depreciating hits from inflation and harsh economic conditions. While this may sound financially wise, it defeats the aim for which you build the fund in the first place. You won’t be able to easily access those funds in the event of an emergency.

At the same time, your emergency funds should not be resting in your chequing account. You’ll only make it easy to use them for non-emergency, and even unnecessary, expenditure. Consequently, this will only loosen your financial security during emergencies.

Instead, you want your emergency fund to be liquid and in an account you do not transact with regularly but can still access in the event of an emergency – even on weekends or during odd hours of the day. Perfect examples would be:

- A high-yield savings account

- A business that runs on liquid assets

- The more convenient money market account.

Is $10,000 Enough For An Emergency Fund?

As we discussed earlier, an ideal amount for an emergency fund will depend on several things peculiar to you.

So, if your average living cost for 3 to 6 months is below $10,000, you do not need to exceed your capacity just to have $10,000 in your emergency fund savings account. But if you average more than that within six months, you should consider having nothing less than $10,000 in your emergency fund. Remember also that your emergency funds can be used as support when you are unemployed for any reason. So, at the barest minimum, it should be able to cover for at least three months of your monthly income or until you are sure of resuming another employment or entrepreneurial activity.