According to the Canadian Payments Methods and Trends Report 2022, Canadians made 404 million cheque transactions valued at $3.3 trillion. That means cheques still get preference despite other alternatives like cash and online payment transfers.

But before you bank that cheque to buy a commodity or pay for a service, ensure your cheque particulars are correct, up-to-date, and you have sufficient funds. If not, expect a bounced cheque – yes, a returned cheque. Sounds frustrating, right?

This comprehensive guide will reveal why cheques bounce, the consequences of bounced cheques, what to do when a cheque bounces, how to avoid your cheques bouncing in the future, and everything in between.

Let’s dive straight into the nitty gritty!

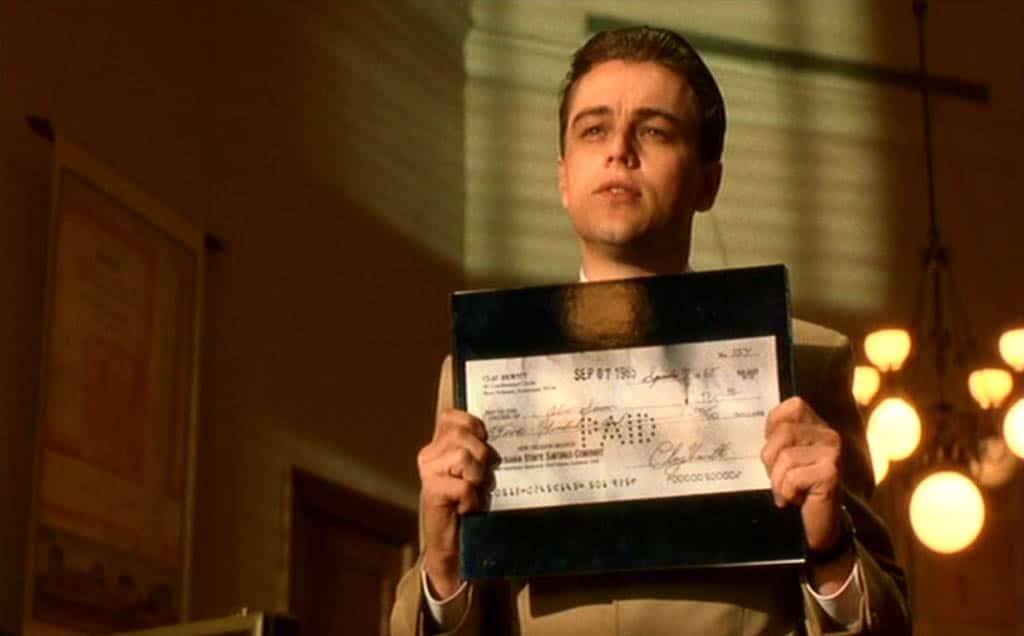

What Exactly is a Bounced Cheque?

A bounced cheque is one that the bank refuses to honor and returns to the payer or bank account owner. It mostly happens because of insufficient funds in payer’s account, meaning the entire process stops. This type of cheque is also called a dishonoured or returned cheque. In Canada, understanding a bounced cheque in Canada is crucial, especially if you write or receive cheques often.

Possible Causes of a Cheque Bounce

Wondering what might cause or increase the chances of your cheque bouncing? Here are four main Cheque bounce reasons in Canada.

- Insufficient funds: It’s the most common reason for a returned cheque. Insufficient funds mean the payer account doesn’t have enough money to cover the cheque amount.

- Damaged cheque: Canadian banks will not accept a defaced cheque. Mutilated, scribbled, overwritten, or corrected cheques are typical reasons for rejection.

- Account issues: A payer might have funds to pay, but when the bank account is old, inactive, frozen, or closed, the payment will not clear. The same applies when your account has a cheque fraud-related history.

- Delayed cheque deposit: You’ll experience this whenever you write a cheque when your account has money, but it’s deposited days later when you’ve already withdrawn the money.

What Are the Consequences of a Bounced Cheque?

So, what happens when your cheque bounces? Here are some of the legal consequences of bounced cheque transactions in Canada.

Possibility of a Legal Action

Repeated cheque bouncing due to insufficient funds is considered a criminal offense under false pretence. The recipient or the bank can file a complaint under Section 361 (1) of the Criminal Code. You must pay a penalty or serve a jail term, depending on the case. Avoiding such legal consequences of bounced cheque activity is important to protect your financial reputation.

Expect Non-Sufficient Fund (NSF) Fees

What is a non-sufficient funds fee?

It’s the amount the bank charges the account holder when they issue an NSF cheque. That’s when the amount in your account is insufficient to cover the cheque. In addition, because the lender tries to withdraw from an account with less money, you get charged with an overdraft fee or a penalty interest – “chargeback” fees.

Your Account Might Vanish

The bank might consider freezing or closing your account. That will make it impossible for you to access your funds. It will also affect your credit score. It isn’t very pleasant, considering that even a petition to reverse this situation will take a while. Taking steps early to understand how to avoid bounced cheques can prevent such outcomes

It Affects Your Credit Score

If your bank reports the bounced cheque occurrences to the two official Canadian credit bureaus, it will negatively impact your credit score. Some lenders are pretty cautious about Credit Scores, which will limit your chances of qualifying for a bank loan.

If this is your situation and you need a loan? Worry not because you can now get prompt bad credit loans in Canada from the BHM Financial Group. We offer medical, mortgage, auto, student loans, etc. Reach out now!

Steps to Take When a Cheque Bounces

Most people will become stranded, wondering about the next steps when a cheque bounces. It’s easy to panic and get overwhelmed, but acting fast before things escalate is the way to go.

Here’s what to do when you know the cheque you sent has bounced:

- Contact Your Bank

Let’s face it: your bank is unhappy that you issued a cheque that bounced; in most cases, you might feel the urge to avoid them. Ignoring them will not solve the issue. Brace yourself and contact the bank to find out why your cheque bounced.

Once you know the specific reason, you will better understand the steps you need to rectify the problem. Some banks might even be willing to guide you through the procedure. Don’t forget to inquire about the NFS fees you attract.

- Apologies to the Recipient

Whether a business partner, organization, or friend, a dishonored cheque can strain the relationship between you and the recipient. Such a mishap will likely make them feel cheated, frustrated, and stressed. Take the incentive to apologize to the recipient.

- Pay the Recipient

Next, find a way to repay the recipient the amount owed without further delay. The amount should include any charges the recipient might have incurred. Sorting the mess helps repair your relationship, especially if it’s a business transaction or when it’s someone close to you.

Discuss a Payment Plan with Your Bank

To restore the lost trust, you must clear all the bank fees you have incurred. If you are not in a position to make the immediate payment, discuss viable scheduled payments. Most banks will be willing to sit down and discuss a convenient payment plan with you.

How to Prevent Bounced Cheques From Now On – 3 Easy Ways

You probably wonder, “How do I write a cheque that will not bounce?” Read on as we outline some of the best measures to prevent bounced cheques below.

Check Your Account Balance

Most people with cheque-bouncing issues ignore checking their bank balance before writing cheques. Your first thing should be to check and confirm that you have sufficient funds to cover the cheque amount. With that, expect no issues from your bank or the recipient.

Check Your Account Status Regularly

Please don’t assume your bank account is in order even when you’ve not been actively using it. It is always safe to double-check with the bank to confirm that the account is active. An inactive, close, suspended, or dormant account status can have your cheques rejected, and that’s not what you want.

Make Use of Cheque Registers

After you send a cheque, keep up with its status until it clears. A neat and professional way to do this is by using check registers. The register will help keep a list of cheques you have written, those pending clearance, account balances, etc. From this, you can know when you have enough funds to cover the upcoming expenses.

Here is some good news: most banks now have platforms that allow you to verify the status of the cheque via a cheque number. Use this option to inquire about the status of one or more cheque numbers. When the cheque clears, you’ll know on time.

Use a Bank with No Fees

When choosing a bank, one feature to consider is the “bank no fee” option. That means the bank does not charge various fees for specific transactions or services. You’ll be surprised not to incur extra charges for bouncing a check.

Avoid Bounced Cheques with BHM Financial Group!

Don’t panic because the cheque you sent has just bounced. Dust yourself off like nothing happened. It’s simple – call +1-877-787-1682 or directly apply for a loan with us at BHM Financial Group. You will get the money in your account within 24 hours and sort out your financial woes.

We don’t judge you based on your credit score; we aim to restore you to a healthy financial position.