Bad credit can be a huge hindrance as you go through life. From finding an apartment to taking out a loan, past mistakes you’ve made with your credit can haunt you. It’s important to work your way out of bad credit, so you can move on with life.

Follow these tips and you won’t have to be troubled with bad credit forever:

- Pay your bills on time. This is the first thing you absolutely must be doing. There’s no way around it. Anyone who suggests there’s some tips or tricks to repairing your credit, where you can go around paying your bills on time, is wrong.

The whole purpose of a credit score is to show people that you’re reliable. It’s about building trust with people to whom you could potentially owe money. Show them the right way by staying on top of your bills and make sure none of your payments are late.

- The longer you stay with the same creditors, the better. Try to avoid cancelling credit cards and closing out accounts, only to get new ones. If you give people a reason to believe you’re running from mistakes, they will believe it.

Loyalty to the same bank and built up trust look good. Try staying with the same bank as long as possible. Only change if you absolutely need to.

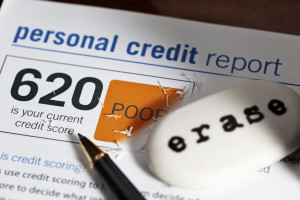

- Make sure you know and understand your credit score.

If you’re reading this article, you likely already have an idea of what your credit score is. That’s great! It’s the first step to recovery. The fact of the matter is, many people with bad credit don’t even know their credit score. Educate yourself on what your credit score is and how it got to be that. Analyze the past mistakes you made so you can learn from them. In the future, you’ll have a better understand of what’s going to lower your score and figure out ways around it.

- Was there a mistake on your credit report that wasn’t your fault?

Many people’s credit reports have some sort of mistake on them that could drastically affect the outcome. Don’t necessarily trust your credit report. It could be better than you think. Go over it in detail. Does everything line up with your past activities? Does something look off? If so, you can fix the mistakes and raise your score easily. Sometimes it pays to be thorough.

- When you’re ready, try applying for new credit.

It’s possible you’ve had to close out some accounts, even if you

tried everything to keep them open. It may be a slow process, but once you’re ready, it’s important to get back into this and start rebuilding credit. Approach this with more care than you have in the past. If people are beginning to trust you again, don’t let them down. You’re ready to start your life as a new, responsible person.

Pingback: Need a loan? Your car is the answer! - BHM FInancial Blog