Reading credit Reports: Everything you should know

Introduction

A credit report shows a breakdown of how you deal with your debts. For example, it shows the type of account, remittance history, and some other details. Besides, your lenders need to report to credit bureaus, enabling them to checkmate how you handled everything.

Likewise, a credit report represents you as an end-user and a debtor. So, it would help if you were responsible for your debts product to get positive feedback. Similarly, all Canadians who use credit must have a credit report. In the same vein of course, it is the Canadian reporting agencies that compile these credit reports.

Who can request credit reports?

Subsequently, a potential pawnbroker or assignee may want to know your credit history and therefore make the request. Therefore, the report gives them information about your credit score and other downsides you may have. Similarly, lenders can assess whether you’re worthy of credit or not. Likewise, people with high credit scores are more likely to be approved for secured lending than those with low scores. Though it’s rare, some Boss’ and Landlords might ask for a credit report. Meanwhile, that is because they want to know how reliable and trustworthy you are.

Moreover, other agencies and individuals that can request for your financial history include:

- Credit card companies.

- Car leasing companies.

- Retailers.

- Mobile phone companies.

- Insurance companies.

- Governments.

- Banks, credit unions, etc.

Furthermore, the organizations mentioned above may use your financial trends to make decisions about you. Subsequently, decisions may relate to either of the following and a host of other situations.

- Provide a credit increase.

- Give you a promotion.

- Collect a debt.

- Lend you money.

- Offer you with insurance.

Importance of checking your credit report.

But, many don’t care about their financial reports. Similarly, some might not even get it, thereby endangering their financial health. So, it is crucial to read and understand your financial history to avoid extra costs. Meanwhile, Reading these details can also save you from denials, and swindlers will not steal your identity.

Above all, checking these reports save you from missing any collapse in your reports. As a result, you might avoid higher interests on loans. Subsequently, due to negligence, some lose their jobs when their employers access their reports.

Luckily, obtaining credit reports are easy and free. Please read it and understand to get the benefit that comes with it. Also, you’ll be able to know the information it contains and how to use it effectively. Besides, it can make your financial experience strong and steady. Hence, this will help to improve your credit score.

Also read: Bad Credit? 5 ways for working your way out!

How to read your credit report?

Your credit report contains details of the transaction history. Once you open an account or make transactions, your creditors should send your information to the two credit bureaus. In this case, Transunion and Equifax. Anytime your lenders send data to the agencies. It shows a number and a letter but that is only the tip of the iceberg.

So, read below to understand what they represent:

Table 1: Meaning of letters in a grade on a credit report.

| Letters. | Meaning. | Example. |

| I | Installment credit.

After borrowing money for a specific time, you will pay in a fixed sum until you finish repaying. |

Car or personal loans. |

| O | Open status credit.You can borrow funds when the need arises, up to a specific restriction. | Mobile phone account. |

| R | Rotating or recurring credit.

You might borrow funds up to your credit restrictions continuously. After that, you can regularly pay in ranges based on what remains in your account. |

Credit card. |

| M | Mortgage loan.Your credit report might include information on mortgages. But, that depends on a particular agency handling your information. | Mortgage. |

Table 2: Meaning of numbers.

| Numbers | Meaning |

| 0 | An Account is approved but unused.

Too new to rate. |

| 1 | Paid within the stipulated time and according to consent. |

| 2 | A Late payment that spans from 31-59 days. |

| 3 | A Late payment that spans from 60-89 days. |

| 4 | A Late payment that spans from 90-119 days. |

| 5 | Late payment above 120 days. |

| 6 | Unused code. |

| 7 | Making installments through the following remittance management alternatives:

|

| 8 | Repossession. |

| 9 | Bankruptcy sent to collection offices or bad debts. |

More examples are:

- Any credit card paid on time shows “R1”.

- For a line of credit, missing a payment by 45 days shows “O2”.

- If a collection office contacts you for reimbursement due to a credit card debt, it will show “R9”.

The best grade is 1, so any number above 1 is detrimental to your credit assessment.

Credit scoring

Your credit score information informs lenders about your creditworthiness. However, credit agencies like TransUnion and Equifax don’t include credit scores on consumer’s credit reports.

Furthermore, the credit agencies use different criteria to assign credit scores to individuals. Therefore your credit score may have different values depending on the agency. Essentially, higher credit scores make companies or individuals trust a consumer and have hope in them.

Credit scoring versions enable organizations to know how a customer will behave in future situations. It also makes them have confidence that the customer will pay up within the stipulated time.

What are agencies, and how do they work?

A credit reporting agency provides information about a consumer’s handling of loans and debt repayments. Therefore, banks and other lenders will furnish these agencies with the necessary information for them to create your profile.

Bureaus will forward your report to the lender or the information owner and hence facilitate further profiling. Furthermore, as mentioned above, this report serves as a risk management factor to the creditors. Of course, these agencies are business organizations, so they often charge their customers.

Besides getting information from financial institutions, credit companies also check your past public records. Consequently, entities with access to a company’s data may know about insolvency, legal judgments, and consumer proposals. Additionally, once you have an account, any potential creditor can request your report.

There are two credit bureaus in Canada: Transunion and Equifax.

However, each has varying details as your lender or creditor may not report to all of them. In Canada, Equifax and TransUnion are the most common but each reports your financial history differently. For example, you’ll find identifying information, credit history, inquiries, and much more.

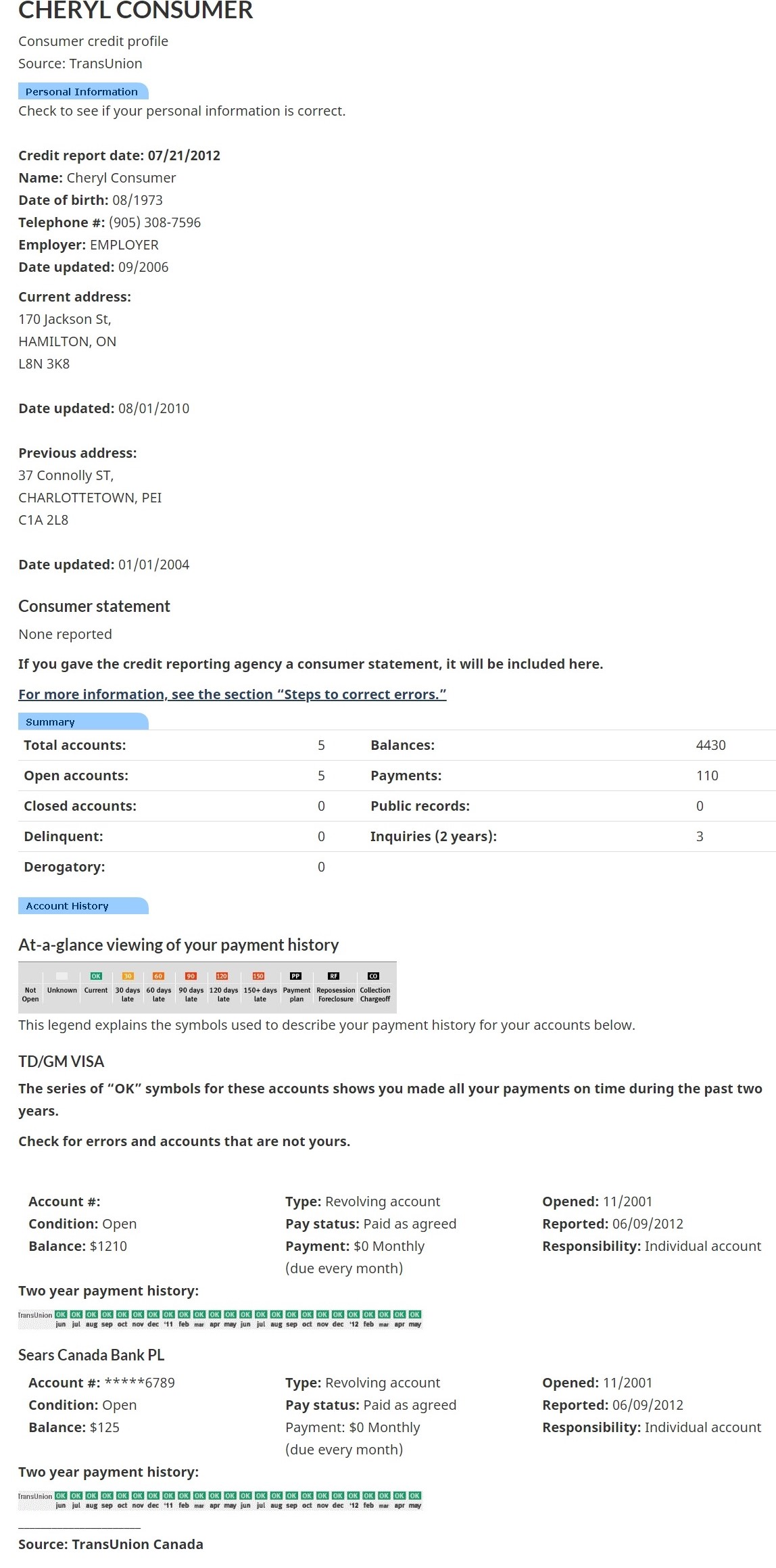

Transunion Credit Report

Below is a sample of your TransUnion credit report and data description:

Brief Overview

The following are the most important information about the Transunion report.

Identifying information includes:

- Name.

- Current and previous addresses.

- Telephone number.

- Date of birth.

- Social insurance number.

- Alias or AKA (otherwise known as).

- Current and previous employer.

Public records include:

- Court judgments.

- Bankruptcies.

- Registered items.

Collection records include:

- Collection records.

- Child support payments.

Credit history gives a recent and previous record of a user’s remittance activity with:

- Retail stores.

- Banks.

- Credit cards.

- Mortgage companies.

- Finance companies.

We have discussed how to read credit reports and why it is important. We have also dissected the TransUnion report in detail. But you need to know a lot of information. Likewise, we will be showing you how to read reports issued by Equifax in a detailed blog post.

Frequently asked questions.

Q: What is a credit report?

A credit report is a record of how you handle credit advanced to you by lenders and other institutions. It shows companies you have engaged with on a credit basis. The report also sheds light on the limits of credit advanced to you by each, and how you paid such loans. It is, therefore, used by lenders and other people use to gauge your reliability with money.

Q: What is the difference between a credit report and a credit score?

A credit report is a record of your history with loans, how much you borrowed and how well you paid up. On the other hand, a credit score is usually a number between 300 and 900. The number is assigned by lenders and credit agencies and is a summary of your credit score. Therefore, a good credit score is often considered to be that above the 600 mark. However, note that different lenders and agencies use different scoring methods. Likewise, thus your score may differ from agency to agency.

Q: Will checking my report impact my score?

No. Checking your credit report does not hurt your score. This is because it is considered a soft inquiry unlike a situation. Similarly, where a lender or other third party checks your report. But the latter is considered a hard inquiry and may hurt your score.

Q: How long does a fraud alert stay on my credit report?

The alert will remain on your file for 6 years from the date it was reported. However, you have nothing to worry about because lenders will have to contact you before advancing credit in your name. Therefore, this protects you from malicious financial activities and identity theft.

Q: Can I get a free copy of my TransUnion credit report?

Yes. You can download a free copy of your report when you TransUnion website online. Their customer support assistants can also send you a copy of your consumer disclosure. This is required in case of reaching them by phone or mail.

Source links.

https://loanscanada.ca/credit/how-to-read-a-credit-report/

https://loanscanada.ca/services/loans/

https://www.nomoredebts.org/blog/how-to-read-your-credit-report

https://www.debtcanada.ca/library/credit-rating-101

https://www.is650agoodcreditscore.com/fico-credit-score-chart/