Navigating the world of personal finance can often feel like traversing a labyrinth. With numerous terms, definitions, and types of credit available, it’s easy to feel overwhelmed. However, a solid understanding of these elements is crucial for managing your financial health effectively. Among the most important concepts to grasp are installment and revolving credit. These two forms of credit play pivotal roles in our financial lives, influencing everything from purchasing decisions to credit scores.

Introduction

In its various forms, credit plays a ubiquitous role in our lives. It can shape our financial future and pave the way for significant milestones like home ownership or higher education. One’s understanding of credit types can be the difference between financial stability and prolonged debt in Canada. This article aims to provide a comprehensive guide on two fundamental types of credit—installment and revolving credit—demystifying their characteristics, usage, and impact on your financial health.

Overview of Credit Types

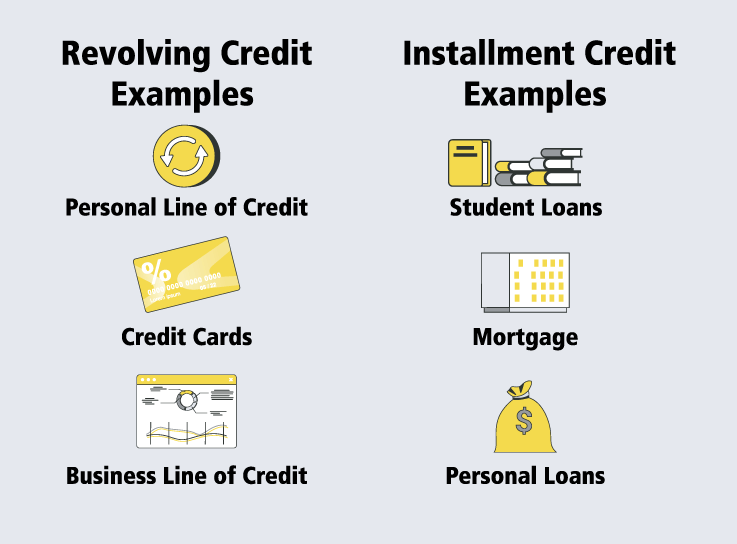

Credit is divided into several categories in personal finance, each with its rules and impacts on financial health. The two most common types are installment and revolving credit. Installment credit refers to a loan a borrower repays in fixed installments over a predetermined period. These include mortgages, car loans, and student loans.

On the other hand, revolving credit is a more flexible borrowing option where the borrower has a credit limit and can make variable payments based on usage. Common examples include credit cards and lines of credit. Both types of credit have distinct features and can affect your credit score differently.

Importance of Understanding Credit Types in Canada

The importance of understanding these two types of credit cannot be overstated. For Canadians, knowledge of these credit types is crucial for several reasons. Firstly, they directly impact your credit score, a key consideration for lenders when you apply for a new line of credit or a loan. Understanding how these credit types work can help Canadians manage their debts effectively and maintain or improve their credit scores.

Secondly, understanding the difference between installment and revolving credit can help Canadians make more informed decisions about the type of credit best suits their needs. For instance, an installment loan may be more appropriate if you’re planning a large, one-time purchase. However, a revolving credit line might be more beneficial for ongoing or unexpected expenses.

Preview of the Article

This article will delve deep into installment and revolving credit, providing a comprehensive guide for Canadians. We’ll start by exploring the characteristics of each type of credit—how they work, their advantages and disadvantages, and how they impact your credit score.

We will then provide practical tips on managing both types of credit effectively. This includes strategies for repayment, understanding interest rates, and how to leverage each type of credit to enhance your financial health.

Finally, we’ll discuss how to balance using both types of credit to optimize your credit score. This balance is essential as lenders prefer a mix of installment and revolving credit on your credit report.

By the end of this guide, you’ll understand how installment and revolving credit work, how to use them wisely, and how they can impact your financial journey in Canada. So, let’s dive in and demystify these essential aspects of personal finance.

What is Installment Credit?

As we navigate the labyrinth of personal finance, comprehending the nuances of different credit types can be a game-changer in our financial journey. Among these, installment credit is a crucial concept, offering a route to significant purchases and playing a major role in shaping our credit history. This section delves into a comprehensive understanding of installment credit, its benefits for Canadians, and how it impacts credit scores. Buckle up as we embark on this enlightening exploration!

Definition and examples of Installment Credit

Installment credit allows you to borrow a specific amount of money that you agree to repay, in total, over a set period. This repayment schedule includes both the principal amount and accrued interest. The critical characteristic of installment credit is its predetermined timeline that the borrower agrees to, which makes it a closed-ended credit.

Examples of installment credit are abundant and part of everyday life. Mortgages, for instance, are a perfect example. When you take out a mortgage, you’re given a large sum to purchase a house, which you then pay back through fixed monthly payments over a period ranging from 15 to 30 years. Auto loans operate similarly; you borrow money to purchase a car and pay off the amount in installments over a few years.

Personal loans, whether obtained for debt consolidation, paying for a wedding, or financing a vacation, are also installment credits. Student loans, used to cover the cost of education, are another typical example. Depending on the loan agreement, these loans are typically repaid in installments over 10 to 25 years.

Benefits of Installment Credit in Canada

Installment credit offers several benefits. Firstly, Canadians can make significant purchases or investments, such as homes or education, which might only be feasible with such recognition. By breaking down a considerable expense into manageable payments, installment credit allows individuals to improve their quality of life, pursue higher education, or even start a business.

Secondly, installment loans usually have fixed interest rates. This means your payment amount stays the same throughout the life of the loan, making it easier to budget and plan your finances.

Thirdly, installment credit can positively impact your credit score. Timely payments demonstrate to lenders that you’re trustworthy and capable of managing debt responsibly. This can increase your chances of obtaining credit in the future.

How Installment Credit Impacts Canadian Credit Scores

In Canada, credit scores range from 300 to 900, with a higher score indicating better creditworthiness. Installment credit can significantly impact these scores.

The effect of installment credit on your credit score depends on several factors, including payment history and the diversity of your credit. Payment history is the most crucial component of your credit score. Consistently making your installment credit payments on time can help improve your credit score.

Additionally, credit mix – the types of credit you have – contributes to your credit score. Lenders like to see that you can handle different types of credit. Installment and revolving credit (like a credit card) can benefit your credit score.

However, it’s important to note that late or missed payments on an installment loan can decrease your credit score. Therefore, it’s essential to ensure you can comfortably afford the monthly payments before taking out an installment loan.

In conclusion, installment credit is a critical component of personal finance in Canada. It allows Canadians to make significant, necessary purchases and improve credit scores when managed correctly. However, as with all financial tools, it must be used responsibly.

What is Revolving Credit?

Understanding the various forms of credit can empower individuals to make informed decisions and effectively manage their finances in the vast financial landscape. One such form of credit is revolving credit, a flexible loan facility that plays a significant role in everyday transactions. This section will delve into the definition and examples of revolving credit, its operation in Canada, and its impact on Canadian credit scores.

Definition and examples of Revolving Credit

Revolving credit refers to a type of credit arrangement that allows borrowers to spend, repay, and spend again up to a specific limit. Unlike an installment loan, where you receive a lump sum upfront and then pay it off with fixed monthly payments, revolving credit is more flexible. You are only required to make minimum monthly payments, but you can also choose to pay off your balance in full.

Common examples of revolving credit include credit cards and lines of credit. A credit card allows you to make purchases up to a predefined limit. As you pay off your balance, your available credit returns, allowing you to use the same credit repeatedly. Similarly, a line of credit provides a set amount of funds you can draw from as needed. As you repay the borrowed money, the amount of available credit replenishes.

How does Revolving Credit Work in Canada?

In Canada, revolving credit works similarly to other parts of the world. You’re given a maximum credit limit once a lender approves you for revolving credit. You can borrow as much as you want up to this limit. Each month, you must make at least the minimum payment by the due date, but you can pay more or even pay your balance in full.

Interest is charged on any outstanding balance. The interest rate can vary significantly depending on the type of revolving credit (credit card, line of credit, etc.) and the lender. Some revolving credit accounts also come with annual fees.

It’s important to note that revolving credit offers flexibility but requires discipline. Since you can continually borrow up to your credit limit, it can be easy to accumulate more debt than you can comfortably repay.

Impact of Revolving Credit on Canadian Credit Scores

In Canada, revolving credit plays a crucial role in determining credit scores. The credit utilization ratio, the percentage of your available credit that you’re currently using, is a critical factor in credit score calculations. A high credit utilization ratio can negatively impact your credit score, indicating that you may need to rely more on credit.

Conversely, adequately managed revolving credit can positively impact your credit score. Regular, on-time payments can demonstrate to lenders that you can responsibly handle credit. However, missed or late payments can harm your credit score.

In conclusion, revolving credit is a versatile financial tool that, when used responsibly, can offer flexibility and contribute positively to your credit score. But it requires careful management to avoid high utilization rates and potential damage to your credit health.

Difference between Installment and Revolving Credit in Canada

The financial realm is often a complex maze with numerous terminologies and concepts. Among the most foundational yet essential elements to understand are the different types of credit, primarily installment, and revolving credit. These forms of recognition serve as the lifeblood of our everyday transactions and shape our financial future. This section will delve into the key differences and similarities between these two credit types, their comparison within the Canadian context, and practical examples that bring these concepts to life.

Key differences and similarities

Installment and revolving credit represent two distinct ways of borrowing money, each with unique features and uses.

Installment credit involves borrowing a lump sum and repaying it over a fixed period through regular installments. Each installment includes a portion of the principal amount and the interest accrued. Examples of installment credit include auto loans, student loans, and mortgages.

On the other hand, revolving credit extends a line of credit to a specific limit, allowing the borrower to draw, repay, and redraw funds as needed. The repayments are not fixed and can range from the minimum payment to the total outstanding balance. Typical forms of revolving credit include credit cards and lines of credit.

Despite these differences, both types of credit share some commonalities. They allow borrowers to access funds when needed, charge interest on the borrowed amount, and require regular repayments. Moreover, the responsible management of both types can positively contribute to the borrower’s credit history.

Comparing Installment and Revolving Credit in Canada

In the Canadian financial landscape, both installment and revolving credit play significant roles. Installment credit is commonly used for large, planned expenses such as buying a house or a car or funding education. It offers the certainty of fixed repayments and a definite end date to the loan.

Revolving credit, with its flexibility and continuous accessibility, is ideal for managing unexpected expenses or short-term cash flow needs. It is also widely used for daily expenditures due to the convenience of credit cards. However, the open-ended nature of revolving credit can lead to higher debt levels if not managed carefully. Additionally, the interest rates on revolving credit, especially credit cards, tend to be higher than those on installment credit.

Practical Examples of Installment and Revolving Credit in Canada

To illustrate these concepts, let’s consider some practical scenarios. Suppose you are a Canadian consumer who has taken a car loan to purchase a new vehicle. This loan represents an example of installment credit, where you repay the borrowed amount plus interest over a predetermined period through fixed installments.

Now imagine you own a credit card with a limit of $2000. This is an instance of revolving credit. You can spend up to $2000, and as you repay, your available credit gets replenished, allowing you to borrow and repay up to your credit limit continually.

Understanding the distinction between installment and revolving credit can help Canadians decide which type best serves their financial needs and circumstances.

Pros and Cons of Installment vs. Revolving Credit for Canadians

Financial decisions often require carefully evaluating the pros and cons of each choice. When choosing between installment and revolving credit, understanding their respective advantages and disadvantages can be instrumental in making an informed decision. This section will delve into the benefits and drawbacks of each credit type, provide guidance on choosing between them, and offer insights into navigating these credit options within the Canadian context.

Advantages and disadvantages of each credit type

Installment credit offers the advantage of predictability. The fixed repayments make budgeting more straightforward, and the interest rates are typically lower than revolving credit. Moreover, timely payments can help build a strong credit history. However, the inflexibility of repayment terms can be a disadvantage. Also, once repaid, the credit becomes available again after reapplying for a new loan.

Revolving credit, on the other hand, offers flexibility. You can borrow as much as you need (up to your credit limit) whenever you need it and repay at your own pace as long as you meet the minimum payments. This type of credit is ideal for managing cash flow and unexpected expenses. However, the ease of access can lead to overspending. The interest rates are typically higher, especially for credit cards, and carrying a high balance can negatively impact your credit score.

How to Choose Between Installment and Revolving Credit in Canada

Choosing between installment and revolving credit depends mainly on your financial needs and circumstances. If you have a considerable, one-time expense and prefer the predictability of fixed payments, installment credit might be the better choice. On the other hand, revolving credit could be more suitable if you need flexibility in borrowing and repaying or if you want a safety net for unexpected expenses.

Your ability to manage debt also plays a role. Revolving credit can be a powerful tool if you’re disciplined about repayments and confident in your ability to manage open-ended credit. But if you prefer a structured repayment plan or worry about overspending, installment credit might be a safer option.

Navigating Installment and Revolving Credit Options in Canada

Navigating your credit options in Canada requires a good understanding of your financial goals, discipline in managing your finances, and awareness of the various credit offerings in the market.

When considering installment credit, look for loans with competitive interest rates and favorable terms. Ensure that the repayment plan aligns with your budget and income pattern.

For revolving credit, compare different credit cards or lines based on their interest rates, fees, credit limits, and reward programs. Always aim to pay off your balance in full each month to avoid high-interest charges.

Remember, both types of credit come with responsibilities. Irrespective of the type of credit you choose, make timely payments, keep your credit utilization low, and monitor your credit report regularly.

Understanding Credit Utilization in Canada: Installment vs Revolving Credit

Credit utilization is a pivotal component of the credit scoring system in Canada, and understanding its intricacies can be crucial for managing one’s financial health. The type of credit—be it installment or revolving—can significantly impact your credit utilization rate. In this section, we will unravel the concept of credit utilization, explore its relationship with both types of credit, and provide practical tips for effectively managing your credit utilization in Canada.

Explanation of credit utilization

Credit utilization, also known as credit usage, is a measure of how much of your available credit you’re using at any given time. It’s usually expressed as a percentage and is calculated by dividing your total credit card balances by your total credit card limits. For example, if you have a credit card with a $5,000 limit and you’ve charged $2,500 to it, your credit utilization ratio would be 50%.

Credit utilization is a significant factor in the calculation of credit scores. Generally, a lower credit utilization ratio is better for your credit score as it indicates that you’re not overly reliant on borrowed money and are likely managing your credit responsibly.

Impact of Installment and Revolving Credit on credit utilization

Installment and revolving credit affect credit utilization in different ways.

For revolving credit like credit cards or lines of credit, your credit utilization ratio can change frequently. It depends on how much of your available credit you use and how much you repay each month. High utilization on revolving credit, especially if you’re close to or at your credit limit, can negatively impact your credit score.

Installment credit, such as a mortgage or auto loan, works differently. When you first take out the loan, your credit utilization may be high because the balance is close to the original loan amount. However, as you make regular payments and reduce the loan balance, your credit utilization decreases. Since installment loans have a set repayment schedule, they offer a predictable way to lower your overall credit utilization over time.

It’s worth noting that credit scoring models typically weigh revolving credit utilization more heavily. This is because revolving credit provides more insight into how a person manages ongoing access to credit.

Tips for managing credit utilization in Canada

Managing your credit utilization effectively can help improve your credit score and overall financial health. Here are some practical tips:

- Keep Balances Low: Aim to keep your revolving credit balances as low as possible. A general rule of thumb is to keep your credit utilization below 30%.

- Pay More Than the Minimum: By paying more than the minimum payment due on your revolving credit accounts, you can reduce your balances faster and lower your credit utilization.

- Consider Your Payment Timing: If you can, consider paying off your balance before the statement closing date, not just before the payment due date. The balance on your statement closing date is typically what’s reported to the credit bureaus and used to calculate your credit utilization.

- Don’t Close Unused Credit Cards: Unless a card has an annual fee that’s not worth paying, keep your old credit cards open even if you don’t use them. Closing a credit card account can decrease your total available credit and increase your credit utilization ratio.

- Increase Your Credit Limit: If you’re eligible, consider requesting a credit limit increase from your card issuer. This can increase your available credit and potentially lower your credit utilization ratio. But be mindful not to see it as an opportunity to increase your spending.

Remember, while credit utilization is important, it’s just one aspect of your financial health. Always strive for a holistic approach to managing your finances, which includes budgeting, saving, investing, and responsible credit use.

Mapping Financial Success: Installment and Revolving Credit

In the realm of personal finance, credit plays a significant role in achieving short-term needs and long-term goals. Both installment and revolving credit can serve as powerful tools in financial planning when used strategically. This section will discuss the role these credit types play in financial planning, strategies for their effective use, and resources for further assistance.

Role of credit types in financial planning

Installment and revolving credit each have unique roles in financial planning.

Installment credit is often used for major financial goals that require substantial funds upfront. This includes purchasing a home or car, investing in education, or making other large investments. The fixed repayment schedule allows for predictable budgeting and can contribute to building a strong credit history.

Revolving credit, on the other hand, provides flexibility for managing cash flow and addressing unexpected expenses. It can also be useful for regular purchases or short-term financing needs. However, the variable nature of revolving credit requires careful monitoring to avoid high utilization ratios and potential impacts on your credit score.

Strategies for effectively using Installment and Revolving Credit

Strategic use of both installment and revolving credit can enhance your financial plan. Here are some strategies:

For installment credit, ensure the loan aligns with your larger financial goals and that the repayments fit comfortably within your budget. Aim to secure the most favorable terms possible, such as the lowest interest rate and flexible repayment options. Also, consider accelerating repayments if your financial situation allows, as this can save on interest over time.

For revolving credit, aim to keep your credit utilization low, ideally below 30% of your available limit. Try to pay off your balance in full each month to avoid interest charges. If you do carry a balance, make sure to at least meet the minimum payment requirements to avoid late fees and negative impacts on your credit score.

Regardless of the type of credit, always make payments on time. Timely payments not only help avoid late fees and potential interest rate increases but also contribute positively to your credit history.

Resources for further assistance

Navigating the world of credit can be complex, and numerous resources are available to help Canadians manage their credit effectively.

The Financial Consumer Agency of Canada (FCAC) offers a wealth of information on understanding credit, improving credit scores, and choosing credit products. Their website also provides resources on budgeting and financial planning.

Credit counselling services, available across Canada, offer guidance on managing debt, improving credit, and creating budgets. These non-profit agencies can provide one-on-one counselling and workshops to help consumers better understand and manage their finances.

Finally, working with a certified financial planner can be beneficial, especially for more complex financial situations or long-term planning. These professionals can provide personalized advice on a range of financial topics, including credit management.

In conclusion, both installment and revolving credit can be integral parts of a well-rounded financial plan. Understanding their characteristics and strategically utilizing them can help Canadians achieve their financial goals.

BHM Financial Group: Your Partner in Understanding Credit

Navigating the world of credit can often seem daunting, especially when you’re struggling with poor or no credit history. But help is at hand with BHM Financial Group, a Canadian company that has been providing asset-based loans since 2005, irrespective of credit ratings. This section will delve into the history, mission, and role of BHM Financial Group in providing asset-based loans and educating Canadians about different types of credit.

BHM Financial Group: A Trusted Resource for Canadians

History of BHM Financial Group and its mission

Since its inception in 2005, BHM Financial Group has been committed to lending money to Canadians who often find themselves in financial straits. Recognizing the lack of credit options for individuals with poor credit history, BHM has made it its mission to offer financing to such consumers across Canada, focusing on assets rather than credit ratings. This approach has allowed BHM to provide attractive terms to thousands of satisfied customers.

Whether clients need a loan due to layoffs, medical bills, or unexpected expenses, BHM is always ready to help. They step in and pay legal expenses and mortgages when banks are looking to foreclose and often act as a line of credit to struggling business owners.

Role in providing asset-based loans, irrespective of credit ratings

BHM offers both secured and unsecured loans. Assets such as cars, mobile homes, land, homes, or boats can all serve as collateral for the loan. This approach allows BHM to extend credit to individuals who may otherwise struggle to obtain traditional financing due to poor or no credit history. The loan repayment plans are tailor-made to fit the client’s lifestyle and financial goals, offering a personalized approach to lending.

How BHM Financial Group Bridges the Knowledge Gap

BHM’s role in educating Canadians about different types of credit

Education is a cornerstone of BHM’s approach to lending. The company believes that informed clients make better financial decisions. To this end, BHM seeks to educate Canadians about different types of credit, including the nuances of installment and revolving credit.

How this education helps clients make informed decisions about installment and revolving credit

By understanding the differences between installment and revolving credit, clients can choose the right type of credit to meet their specific needs. Installment credit, with its fixed repayment schedule, can be ideal for large, one-time expenses. In contrast, revolving credit offers flexibility, making it suitable for managing fluctuating cash flow needs or unexpected costs.

Credit Options at BHM Financial Group

Explanation of secured and unsecured loans offered by BHM

BHM offers a range of loan products, including car title loans, mobile home loans, truck loans, trailer loans, RV loans, horse trailer loans, farm equipment loans, first and second mortgages, small business loans, and boat loans. These financing methods are based on the value of the client’s vehicle or other assets, not on their credit history.

How these loan options relate to installment and revolving credit

These loan options primarily fall under the category of installment credit, given their nature of fixed repayments over a predetermined period. However, they also exhibit some characteristics of revolving credit, as the loan amount is based on the value of an asset, which can fluctuate over time.

Navigating Credit Options with BHM Financial Group

How BHM helps Canadians navigate installment and revolving credit options

BHM assists Canadians in navigating their credit options by providing a unique approach to lending that supports financial planning. They educate clients about the pros and cons of different types of credit, enabling them to make informed decisions that align with their financial goals.

Discuss how BHM’s unique approach to lending supports financial planning

BHM’s approach to lending is designed to support financial planning by providing flexible loan options based on assets rather than credit history. This allows clients to access funds when they need them most, regardless of their credit score, thereby supporting their financial planning efforts.

Understanding Credit Utilization with BHM Financial Group

How BHM helps clients understand the concept of credit utilization

BHM helps clients understand the concept of credit utilization and how their loans impact it. They educate clients on how to keep their credit utilization low to maintain a good credit score, even when using their loan products.

The impact of BHM’s loans on credit utilization

BHM’s loans can potentially lower a client’s credit utilization ratio, as they increase the client’s available credit. However, clients are advised to use these loans responsibly and make timely repayments to avoid negatively impacting their credit score.

No Credit Loans: A Unique Offering by BHM Financial Group

Explanation of no credit loans and how they differ from traditional credit options

BHM also offers no credit loans, providing a unique solution for those struggling with credit scores. These loans are available to a wide range of vehicle owners, including car, truck, RV, boat, mobile home owners, and more. Clients get to keep and use their collateral for the duration of the loan, removing the financing hassle for people with no credit by providing them with loans despite their credit history.

How no credit loans can provide an alternative for those struggling with credit scores

No credit loans provide an alternative for individuals struggling with credit scores, as these loans are based on the value of the client’s vehicle or other assets, not on their credit history. This makes them an attractive option for individuals who might otherwise struggle to secure traditional credit.

In conclusion, BHM Financial Group serves as a trusted partner for Canadians, helping them navigate their credit options, understand credit utilization, and make informed financial decisions. Their unique approach to lending, coupled with their commitment to education, makes them a valuable resource in the world of credit.

Conclusion

Navigating the world of credit can often seem like an overwhelming task. However, with a partner like BHM Financial Group, this process becomes significantly more manageable. Ever since its inception in 2005, BHM has been unwavering in its commitment to provide asset-based loans to Canadians, irrespective of their credit ratings.

The company has been instrumental in offering both secured and unsecured loans, helping Canadians understand the intricacies of installment and revolving credit. This educational initiative has empowered many individuals to make informed decisions about their financial future. Moreover, BHM’s unique approach to lending supports financial planning, making them a reliable partner in managing your finances.

BHM also takes it upon itself to help clients understand credit utilization and the impact loans have on it. This knowledge is crucial as it helps individuals maintain a good credit score, which can be beneficial in the long run. For those struggling with credit scores, BHM offers no credit loans as an alternative. This unique offering underscores BHM’s commitment to providing financial solutions to all Canadians.

Understanding different types of credit is crucial for Canadians. It helps you navigate through various financial options, manage your finances effectively, and plan for a secure future. With a company like BHM Financial Group, you can rest assured that you have a reliable partner who will guide you through the complexities of credit.

We encourage you to explore the services provided by BHM Financial Group. Their commitment to educating their clients, coupled with their innovative financial products, makes them a go-to resource for any credit-related queries or needs.

We hope this article has provided you with valuable insights into BHM’s services and the importance of understanding credit. If you have any questions or comments, feel free to share them. Your engagement helps us create content that is relevant and useful to you. So, don’t hesitate – ask questions, share your thoughts, and let’s keep the conversation going.